Visit Tech Alliance

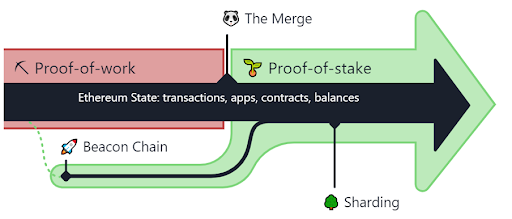

This past Thursday there was a noteworthy event in the crypto space. The Ethereum main chain was upgraded from a proof-of-work consensus algorithm to a proof-of-stake one. Like a train switching from an old well-worn track to a shiny new one, it went seamlessly, which is a big win for Ethereum, but also for open source developers who had been planning the transition for the past seven years.

The actual merger was between the main Ethereum chain as we knew it and a separate, newer chain called Beacon that has been running in parallel for the past 20 months. The Beacon portion was the proof-of-stake side and, until the merge, had not processed any transactions. Now there is just a single chain run by validators instead of miners requiring significantly less computing equipment (read electricity). Rather than miners collecting the block rewards, they are now issued to validators. And although you will need 32 ETH, or about $80,000 NZD, to be a validator, you can get exposure to the block reward yield—previously only accessible to miners—by joining a staking pool.

But there’s a lesson on human adaptation here too. Just because the new version of Ethereum doesn’t need as much electricity in the form of GPU mining hardware, it doesn’t mean people will turn off their mining equipment and call it a day. An old foe has recently surged in hashrate so that now if you account for Ethereum Classic (ETC) the power usage hasn’t dropped as much as advertised.

Just as people are incentivised to use their graphics cards to mine whatever is profitable, others may be incentivised to buy, invest, stake, and hold their ETH. With this network upgrade the total supply of ethereum tokens (ETH) has started to decrease because there is 80-90% less ETH being issued as well as a prior upgrade that burns a base fee in each transaction. Money nerds call this a deflationary supply.

Meantime, some are saying The Merge was anticlimactic, meaning nothing broke (yet). Others are saying that bitcoin just lost a major proof-of-work competitor. Vitalik says proof-of-stake Ethereum is not a security because it has no voting capabilities (and therefore is a commodity), while Gary Gensler says it could be a security (and therefore regulated like one).

To no one’s surprise, there are strongly opinionated voices both in favour of the upgrade and opposed to it. Those in favour say it’s more secure due to finality checkpointing, more financially inclusive due to staking rewards, and better environmentally. Those opposed point to wealth distribution, saying the Ethereum founders got rich through their pre-mine and now proof-of-stake is a rich-get-richer scheme allowing privileged folks to invest in Ethereum staking. Others dislike the seemingly centralised manner in which the network decides on upgrades and can enact changes to the code, thereby changing the rules of the game.

Either way, you’ll have to wait for future upgrades for fees to fall and performance to improve; stay tuned in 2023 for sharding and The Surge which should dramatically improve network throughput. Investors will be on the lookout for the Shanghai upgrade, which will allow people to withdraw their staked ether. And there is a lot of it. About 12% of the supply, or around $21B USD, has bet on Ethereum maintaining its smart contract platform edge.

BlockchainNZ Podcast:

Led by Bryan Ventura (BlockchainNZ Chair) and Jeff Nijsse (BlockchainNZ council), the BlockchainNZ Podcast, holds an interview with one BlockchainNZ member each episode to talk about all things blockchain, crypto, NFTs, DeFi and more!

Check out our latest episode, where Jeff Nijsse and Bryan Ventura host their first roundtable where they discuss Tornado cash and Eth2.0 “The Merge”.

CryptocurrencyNZ Meet-ups:

Come and join us in your city for the monthly cryptocurrency and blockchain community meet-up held on the last Wednesday of every month. For more information and to see where your city meet-up is, check out our website here. Hosted by CryptocurrencyNZ and supported by BlockchainNZ.

Crypto Legal Working Group:

Members are welcome to join our working group to assist our community to understand the laws and regulations surrounding cryptocurrencies. If you would like to be involved, please email us at team@blockchain.org.nz.

Call for Articles:

Anything interesting being developed in your space? Do you have an opinion on the direction of blockchain and want to produce an insightful thought piece for our website? We’d love to hear from you. To submit an article, or for more information, please email us at team@blockchain.org.nz.

Ngā mihi nui,

Alison Mackie

BlockchainNZ Executive Director